It’s Christmas time in the US Solar industry and all the solar children think they know what is under the tree.

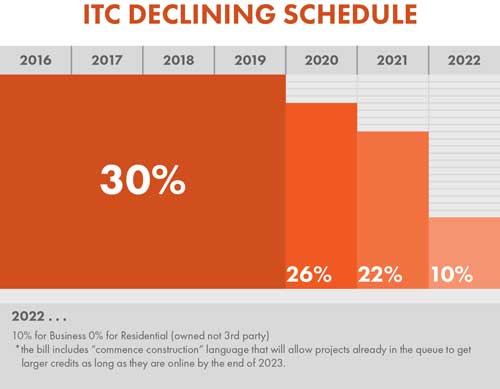

How about an extension of the Solar ITC through 2019 with step-down tax credits thereafter allowing installations in the construction queue to receive some level of benefits out to 2023? The table below gives the basic sense of the measures contained in HR 2029 – The fiscal package in which the provisions are embedded.

The final count is not in, but Washington insiders are telling tales of solid bi-partisan support for the Bill in both houses and votes are expected before the end of Friday. The industry reaction has been jubilant for the most part and the stock market has responded positively.

Solar and renewables aside, the Omnibus bill itself is an exercise in compromise in which nobody gets exactly what they want and everybody gets something they want. Crude oil exports also get a nod in the bill with the removal of the current export ban.

On that point, some predict a fracking doomsday as oil exporters in the US ramp up to meet international demand, while others focus on the possibility of lower gas prices and better balance of trade through more competition on the global market. Given current crude prices at $35 per barrel and relatively high costs of fracking – this seems less likely than it did in early 2014 when prices when prices were steady at over $100 per barrel.

Despite these concerns, more and more utility companies have been turning to renewables as core elements of their power generation strategies because technologies like solar have reached pricing levels that are competitive with fossil fuels in the marketplace.

Bloomberg, Fortune, Forbes, the New York Times and other major news organizations have all carried recent articles comparing wind and solar with traditional energy generation. Most of these are comparing on a 20-30 year Levelized Cost of Energy model which doesn’t account for the true lifetime of solar (often greater than 40 Years).

They also don’t calculate disposal and environmental costs attributable to fuels like oil and nuclear. When numbers are pushed out to accurate estimations solar wins the energy race – even without incentives or tax credits.

Which brings me to my main thoughts:

1) Is the extension of the ITC good for Solar?

2) What impact will it have on the Solar Industry and on the US Economy?

3) Should we use incentives to drive new technology?

Is the extension of the ITC good for Solar?

The extension of the 30% Federal Tax Credit will undoubtedly create a clearer path forward for solar over the next 5 years. Heck, it may even provide a moment of stability to a world in which the news changes daily! It will allow solar integrators to plan long term and cement the commitment of solar financiers to the market.

This will continue to drive adoption and even lower prices as manufacturers can lean more on installation forecasts and less on hocus-pocus guessing.

The ITC extension will also slow down the solar industry a bit because it will continue to suck at the teats of government largess. What government gives to, it over regulates and over regulation always slows business, increasing soft costs and complicating the process.

Additionally, extending the ITC may push out some of the best solar solutions because neither the industry nor the financiers driving the engine will find it necessary to create options that give true global access to everyone. The focus could remain on a limited wealth market and be diverted from crafting solutions that will work for everyone regardless of tax appetite.

Take for instance the Power Purchase Agreement or PPA in the residential market. This model offers discounted solar power to the homeowner in return for the financier’s ability to affix a solar array to the host’s roof for the next 20 – 30 years. The financier gets the tax benefits (often at an inflated rate) and any other incentives including the solar payments from the homeowner.

Unfortunately, the next homeowner often has to pay the piper since they must re-confirm the PPA on purchase of the home and the array does not add value to the home because it is the property of the financier. The PPA has been touted as a solution for lower income individuals, but really results in further depressing those housing markets and contributes to the rise of a new distributed energy utility in the hands of – guess who – Bankers.

What Impact will the Extension of the Solar ITC have on the Industry and the Economy?

While it may be too early to tell, green research organizations like Green Tech Media are estimating installation increases of 54% through 2020 if the extension continues. Mike Munsell posited that the growth would be most pronounced in the utility scale sector (see here). This is accurate, because utility scale is where big finance likes to play when accessing and maximizing tax credits.

“Good news has finally replaced bad news for the solar space as Congress is reportedly closing in on a deal that would extend the ITC beyond the original expiration date of 2016. An analysis by GTM Research estimates that the U.S. would install an additional 25 GW of solar PV if Congress extends the ITC along the lines proposed in the current draft legislation.

— wrote William Pentland , FORBES Energy and Environment Contributor

Ultimately, the extension is sure to bridge the gap between decreasing solar costs and increasing electric rates. This means that by the time the ITC fades to 10% in 2022 solar should be fully sustainable and competitive with other generation methods and able to live and breathe without further infusion.

This is also good news for the economy on several fronts. Energy costs have long been subsidized in the US, leading to lower energy costs but slowing innovation compared to the rest of the world. This is why Europe has outstripped us in development of renewables – they made sense earlier because they were competing with fossil fuels operating in a true cost structure.

With the extension, we will continue to drive the growth of renewables at a rate which will force grid modernization at an increased pace and result in a continued influx of investment into this vital structure. This means that both the utility and renewable industry have good job security for the foreseeable future and that both private and public investment will continue to flow.

Some may point to the continued increase in energy prices and try to tie them to renewables. The truth is that energy prices in the US have been consistently rising for decades and that long term subsidies for gas, oil, coal, nuclear, and hydro are still keeping them artificially low compared to the rest of the world.

Energy prices will have to right-size in the new global economy and when they do, renewables will be the place to be. This rise has not been hastened or slowed by renewables and has some distance to go before reaching true costs.

The fact that solar penetration in the US was still at about .4% of total generation in 2014 (see here) also tells a story. Conservative estimates put solar much closer to the cost of baseload power than many have previously believed according to Tara Patel at Bloomberg Business who recently reviewed a report from the International Energy Agency comparing fuel sources (see here).

Even if we aimed high and put those costs at double – what is the statistical effect of a double cost in .4% of the market? The math is pretty easy – it’s a bit less than .2% or about $1.80 per year on the average American’s utility bill. And that is when competing against other subsidized sources operating fully at scale!

Overall, the extension of the ITC will grow both the US and the Solar economy and continue to attract investment and aggressive infrastructure renewal in the energy sector.

Should we use Incentives to drive New Technology?

That is kind of like asking whether we should reward Johnny for getting an A. An incentive simply represents an early reward for a desirable behavior engineered to drive adoption.

Mankind has used this approach for centuries – and everyone understands that the proper use of incentives can make the difference between the success and failure of any enterprise. For many years, I have operated in a number of environments – from education to sales.

In all, I have made effective use of incentives to drive the right sort of energy in the right sort of areas.

Let’s not forget that today’s utilities have experienced incentives that far outstrip the incentives offered to today’s renewables. Most of them got their start in an era where unregulated low wages kept the majority of the population in poverty, no insurance or safety requirements resulted in death and dismemberment on the job, and plentiful land grants from the US government ensured crazy profits for the emerging industrialists.

Compare the regulated business industry of today with that of yesteryear and you are left with an implied incentive that blows your mind. Add to that the actual cash and tax incentives received by coal and oil and you have a staggering number.

Calculate for inflation rates and the value of money today compared to the past and the gap widens further. For those data engineers who doubt me take a look at this review of a 2011 study by Nancy Pfund and Ben Healy (Yale University) on the history of Federal Energy Subsidies through the year 2009.

This study leaves out the value of all the historical advantages listed above and just calculates the direct subsidies.

Given our history, we should know better than to trust economic opinions coming from industrial giants who only stand to lose from the shift in power. The loan crisis of 2007-2008 is still a stinging memory of what happens when we let the titans of industry tell us what is good for us. I am not anti-industry, but am willing to admit that we have always lived in an era where avarice, greed, and self-protection will always trump the greater good when the economic powers that be are not held in check by reasonable and data driven regulation.

My money is on clean power for the future – I think it will prove to be good for both the environment and the pocketbook.

About

Ethan DeSota serves as Director of Marketing for EthoSolar. He loves nothing on earth more than his wife and five children, is passionate about youth, urban farming, green architecture, and solar. As a NABCEP certified professional and licensed contractor he has participated in the sales, oversight, and installation of hundreds of residential and commercial solar systems.

EthoSolar: EthoSolar is a residential and commercial solar integrator serving Canada and the Northeastern United States. Our passion is to build strong, sustainable communities through the power of solar. Go to www.ethosolar.com to find out more or to www.etho.so/getstarted to request a free solar evaluation.

Comments