Anyone working in clean tech today (or paying attention) knows that the disruption in the U.S. energy infrastructure is picking up speed.

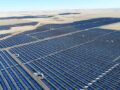

Take solar alone. The U.S. installed over 7GW of solar in 2015, up 16% over 2014, and the largest annual total to date (source: GTM Research). Plus, GTM forecasts we’ll install 16GW of solar in 2016, up 120% over 2015, and an astounding 26GW – more than all solar to date – over the next two years.

Use of renewables is accelerating as fast as they can be built, driven by a combination of technological advances, policy, declining costs, and society’s growing commitment to a clean energy future. 49 of America’s largest companies have signed onto the Corporate Renewable Energy Buyers’ Principles; RE100 initiative has 53 large corporate signees; and 154 companies have signed the American Business Act on Climate Pledge.

Good job, folks.

Is the ultimate potential a self-sustaining power source for every home, company or institution? Will the disruption go that far?

Like other recent industry disruptions, it’s probably somewhere in the middle. After all, we have both Uber and taxis, Airbnb and hotels, online shopping and bricks and mortar. So, the infrastructure of the future is likely to be a hybrid of the existing centralized utilities model, with an enormous expansion of decentralized energy sources, or distributed generation (DG).

On one hand, our aging power grid has begun a long period of retiring and replacing plants, transformers, and transmission lines near or past their expiry dates. In the last two years investor-owned utilities spent close to $200 billion on infrastructure, and are projected to spend at least $90 billion annually over the next few years according to Utility Dive.

In 2016 alone, 41 coal-fired power plants with generating capacity over 5.3GW are scheduled to be retired. Most will be replaced by centralized solar, natural gas, and wind power plants. Among the 26GW of new power plants coming online in 2016, 9.5GW, or 36.5% will be solar. (Source: U.S. Energy Information Administration)

On the other hand, we have an early trend of large utility hidden companies and energy companies expanding into DG. Last year, Duke Energy, the nation’s largest electric utility, acquired of a majority interest in REC Solar to expand into commercial solar. And then, last month Southern Company announced that it is acquiring PowerSecure, who provides distributed generation, energy efficiency and utility infrastructure solutions, to expand its portfolio of services to include DG.

Then, just last week, Sol Systems announced the launch of its strategic partnership with Sempra U.S. Gas and Power. Unlike other M&A activity in the distributed generation space, we will explore co-investment opportunities in both DG assets and companies. While Sempra was an early mover in the development of utility-scale renewable energy and natural gas solutions, this is their first initiative in the DG space where Sol Systems has been an early mover.

If this trend continues, we are sure to see expansive growth in DG, alongside centralized replacements. Distributed or centralized, our clean energy future is now.

Great headline! Who was here last week! Who was here last week? Yes! I thought Yes was dead.

Was there an opening act, or was The Who on first?

(Credit my nephew – he made that joke when I saw The Who last year.)